CEE monetary policy developments (Martin Ertl)

14 Aug

Romania: The National Bank of Romania has, surprisingly, signaled a near end to its rate hiking cycle in spite of inflation above target. Serbia: With economic growth accelerating and inflation contained, the National Bank of Serbia has no need to change its monetary policy stance. Romania In no other European Union member state, inflation is as high as in Romania. While for the whole European Union, Eurostat’s harmonized consumer price index (HICP) increased by 2.0 % in June, inflation was at 4.7 % in Romania. Using the domestic consumer price index, inflation was even higher at 5.4 %, although it decreased to 4.6 % in July. In spite of high inflation, the National Bank of Romania (NBR), has decided to keep monetary policy interest rates unchanged during the Board’s meeting on Aug... » Weiterlesen

Macroeconomics a decade after the Great Recession (Martin Ertl)

06 Aug

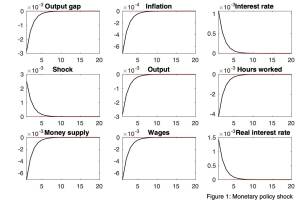

What has changed during the last ten years Modern macroeconomics under fire Extensions of the baseline New Keynesian macro model “Economist have learned nothing from the crisis, stick to their wrong models, operate within a very constrained model world and stubbornly believe in the homo oeconomicus” are regularly formulated accusations vis-à-vis the profession (Martin Halla). Famously, right at the onset of the Great Recession in 2008, Olivier Blanchard wrote an article which concluded that “the state of macro is good” what kind of went terribly wrong. Although Blanchard discussed mainly how a convergence in methodology had emerged (sometimes called the “new neoclassical synthesis”), after the “field looked like a battlefield” before the 1... » Weiterlesen

Eurozone business cycle monitoring (Martin Ertl)

31 Jul

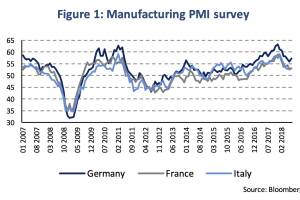

Uncertainty increased recently amid conflicting signals. Survey data softened further in July, while financing conditions remain favorable. On Tuesday, the Q2 GDP release will add an important information. Business cycle uncertainty has recently been increasing in the Euro Area. We observe downward signals from a number of cyclical indicators which conflict with a broad strength in macroeconomic trends. The first Eurostat Q2 GDP release on Tuesday 31 st July will add another indication about the state of the business cycle. The most visible downward trend in time series comes from prominent survey data. The purchase managers surveys (PMI) – both contemporaneously correlated with GDP and forward-looking – have been losing momentum since January (Figure 1). In July, the surveys for... » Weiterlesen

International trade in Central and Eastern European EU member states and non-EU ac...

23 Jul

Trade openness is high whereby the EU is the most important trading partner. The structure of trade differs substantially. Negative EU trade balances are substantial except for the CE-4. International trade drives economic growth. That trade should not only be seen as an important by-product of economic growth, but as a crucial determinant of higher income levels, is a widely held, well supported, though heavily debated view, in economics. Frankel and Romer (1999, p. 394), for instance, find a causal positive effect of trade on income arguing that “a rise of one percentage point in the ratio of trade to GDP increase income per person by at least one-half percent” [1]. A higher degree of trade openness is associated with more pronounced capital accumulation as well as higher producti... » Weiterlesen

Is the Euro Area hitting capacity constraints? (Martin Ertl)

16 Jul

Euro Area GDP growth slowdown is likely to extend into the second quarter, despite a rebound of industrial production in May. Capacity utilization has reached levels well above the long-term average and close to 2007. Insufficient demand and labor shortages are the most significant factors limiting production. Investment activity in the Euro Area has, not yet, reached pre-crisis levels. Labor productivity growth has been remarkably similar between the pre- and post-crisis period, though, at markedly lower employment growth. Euro Area economic growth slowed down during the first quarter of the year and business cycle indicators, like industrial production, retail sales or sentiment indicators, have, so far, signaled an extension of muted growth into the second quarter. Quarter-on-quarter (... » Weiterlesen

26.05.24

26.05.24

Ich bin mit dem deutschen Börsenradio nun seit 2015 verschränkt, damals machten wir gemeinsam die CD (also nicht ein Wortspiel mit meinen Initialen "Audio-CD", sondern echt eine Compact Disc) in diversen Sondereditionen zum 25er des ATX Anfang 2016, launige Interviews und Erinnerungen mit Zeitzeugen. Als dann der neue Börsechef Christoph Boschan nach Wien gekommen ist, konnte ich die Kooperation mit den Vorstandsinterviews einfädeln, meine Kollegen Peter Heinrich und Sebastian Leben (er ist schwer erkrankt, stand mehr als nur an der Kippe, war aber stark und ist jetzt wieder im Kapitlalmarkt tätig, er hatte offen über sein aggressives Glioblastom gesprochen) waren fortan als Interviewer für Vorstandsinterviews aus Österreich am Tag der Zahlen zuständig. Ich war da zunächst nur der Einfädler, dann kam aber selbst die Lust zu podcasten und wir arbeiten vielfältig zusammen. Mittlerweile agiert Peter Heinrich mit Andreas Gross aus den Studios A und B aus Deutschland und ich nenne meine beiden Setups Studio C (für Podcastgäste) und Studio D (für Marktberichte). Die Deutschen machen Vorstandsinterviews und Schlussberichte, ich mache Live-Einstiege intraday und Werdegang-Podcasts. Passt gut!

26.05.24

26.05.24