ams AG / ams announces the successful pricing of additional EUR 200 million 6% senior notes due 2025 and of additional USD 50 million 7% senior notes due 2025

13.07.2020, 8028 Zeichen

Premstaetten - Premstaetten, Austria (13 July 2020) - Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

No Keyword

- ams (SIX: AMS), a leading worldwide supplier of high performance sensor solutions, announced today the successful pricing of an additional EUR 200 million aggregate principal amount of senior notes due 2025 at a coupon of 6.00% per annum at an issue price of 100.75% and implied 5.82% yield to maturity, and an additional USD 50 million aggregate principal amount of senior notes due 2025 at a coupon of 7.00% per annum at an issue price of 100.75% and implied 6.82% yield to maturity (the "Additional Notes"), in connection with the acquisition of OSRAM Licht AG.

ams intends to use the proceeds from the offering of the Additional Notes for general corporate purposes (including the refinancing of existing indebtedness) and to pay certain fees and expenses related to the offering of the Additional Notes. The offering of the Additional Notes is expected to close and the Additional Notes are expected to be issued on or around 20 July 2020. ###

Important notice: This press release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy the Additional Notes, nor shall it constitute an offer, solicitation or sale in any jurisdiction in which, or to any person to whom, such offer, solicitation or sale would be unlawful. The Additional Notes have not been and will not be registered under the U.S. Securities Act of 1933 ("Securities Act") or the securities laws of any state of the United States of America, and may not be offered or sold within the United States of America or to, or for the account or benefit of U.S. persons (as defined in Regulation S) or any persons. except pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will be no public offering of Additional Notes in the United States of America.

This announcement does not constitute and shall not, in any circumstances, constitute a public offering nor an invitation to the public in connection with any offer within the meaning of European Prospectus Regulation (EU) 2017/1129 (the "Prospectus Regulation"). The offer and sale of the Additional Notes will be made pursuant to an exemption under the Prospectus Regulation, from the requirement to produce a prospectus for offers of securities.

This announcement does not constitute and shall not, in any circumstances, constitute a public offering nor an invitation to the public in connection with any offer within the meaning of the Swiss Financial Services Act ("FinSA"). The Additional Notes may not be publicly offered, directly or indirectly, in Switzerland within the meaning of the FinSA and no application has or will be made to admit the Additional Notes to trading on any trading venue (exchange or multilateral trading facility) in Switzerland.

Manufacturer target market (MIFID II product governance) for the Additional Notes is eligible counterparties and professional clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared as not available to retail in EEA or the United Kingdom.

This announcement is being distributed to, and is directed at, only (1) persons who are located outside the United States and are (a) persons in Member States of the European Economic Area who are qualified investors (as defined in the Prospectus Regulation); (b) persons in the United Kingdom who have professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order"); (c) high net worth companies, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order; or (d) persons to whom an invitation or inducement to engage in an investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated or (2) persons who are reasonably believed to be "qualified institutional buyers" (as defined in Rule 144A under the Securities Act) (all such persons together being referred to as "relevant persons"). The investments to which this announcement relates are available only to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such investments will be available only to or will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Persons distributing this announcement must satisfy themselves that it is lawful to do so.

This announcement may contain statements about ams and/or its subsidiaries (together "ams Group") that are or may be "forward-looking statements". Forward- looking statements include, without limitation, statements that typically contain words such as "anticipate", "target", "expect", "estimate", "intend", "plan", "believe", "hope", "aims", "continue", "will", "may", "should", "would", "could", or other words of similar meaning. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. ams cautions you that forward-looking statements are not guarantees of the occurrence of such future events or of future performance and that in particular the actual results of operations, financial condition and liquidity, the development of the industry in which ams Group operates and the outcome or impact of the acquisition and related matters on ams Group may differ materially from those made in or suggested by the forward-looking statements contained in this announcement. Any forward-looking statements speak only as at the date of this announcement. Except as required by applicable law, ams does not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise.

About ams ams is a global leader in the design and manufacture of advanced sensor solutions. Our mission is to shape the world with sensor solutions by providing a seamless interface between humans and technology. ams' high-performance sensor solutions drive applications requiring small form factor, low power, highest sensitivity and multi-sensor integration. Products include sensor solutions, sensor ICs, interfaces and related software for consumer, communications, industrial, medical, and automotive markets. With headquarters in Austria, ams employs around 8,500 people globally and serves more than 8,000 customers worldwide. ams is listed on the SIX Swiss Exchange (ticker symbol: AMS). More information about ams can be found at https: //ams.com https://ams.com/

Join ams social media channels: >Twitter https://twitter.com/amsAnalog >LinkedIn [https://www.linkedin.com/ company/ams-ag] >Facebook https://www.facebook.com/amsAnalog >YouTube [... /www.youtube.com/user/amsAnalog]

ams is a registered trademark of ams AG. In addition many of our products and services are registered or filed trademarks of ams Group. All other company or product names mentioned herein may be trademarks or registered trademarks of their respective owners. Information provided in this press release is accurate at time of publication and is subject to change without advance notice.

end of announcement euro adhoc

issuer: ams AG Tobelbader Strasse 30 A-8141 Premstaetten phone: +43 3136 500-0 FAX: +43 3136 500-931211 mail: investor@ams.com WWW: www.ams.com ISIN: AT0000A18XM4 indexes: stockmarkets: SIX Swiss Exchange language: English

Digital press kit: http://www.ots.at/pressemappe/2901/aom

kapitalmarkt-stimme.at daily voice 178/365: Die Sonne scheint, aber die wilde Reise von SunMirror an der Wiener Börse könnte enden

ams-Osram

Uhrzeit: 22:15:13

Veränderung zu letztem SK: 0.00%

Letzter SK: 0.00 ( 0.00%)

Bildnachweis

1.

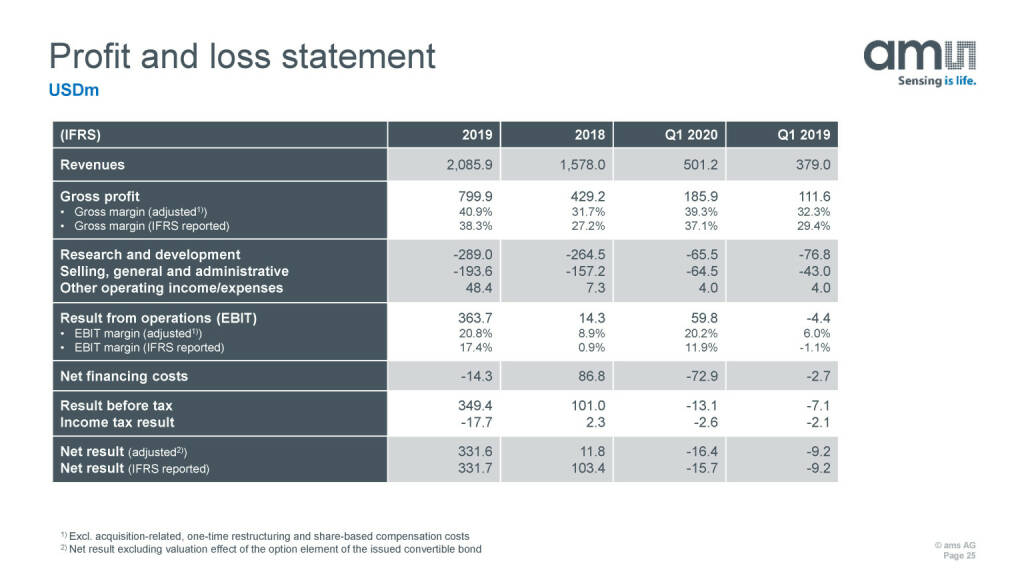

ams - Profit and loss statement

>> Öffnen auf photaq.com

Aktien auf dem Radar:Kapsch TrafficCom, Semperit, Flughafen Wien, Pierer Mobility, Amag, Austriacard Holdings AG, Mayr-Melnhof, VIG, Strabag, voestalpine, CPI Europe AG, AT&S, Österreichische Post, CA Immo, UBM, DO&CO, Gurktaler AG VZ, Wienerberger, Palfinger, Marinomed Biotech, Stadlauer Malzfabrik AG, Oberbank AG Stamm, Addiko Bank, Uniqa.

Random Partner

Schwabe, Ley & Greiner (SLG)

Das Unternehmen SLG wurde 1988 gegründet und ist spezialisiert auf die Beratung im Bereich Finanz- und Treasury-Management.

Wir sind Marktführer im gesamten deutschsprachigen Raum und verfügen über einen soliden Partnerkreis. Diesen haben wir zur Stärkung des Unternehmens kontinuierlich erweitert.

>> Besuchen Sie 60 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX legt am Freitag 1,4 Prozent zu

- Wiener Börse Nebenwerte-Blick: RHI Magnesita stei...

- Wie Wienerberger, DO&CO, Lenzing, OMV, Verbund un...

- Wie RHI Magnesita, Kapsch TrafficCom, Pierer Mobi...

- Österreich-Depots: Starke Wochenendbilanz (Depot ...

- Börsegeschichte 27.6.: HTA, Polytec, Wienerberger...

Featured Partner Video

Wiener Börse Party #922: ATX etwas fester, bei Palfinger spitzt sich jetzt etwas Angekündigtes immer mehr zu, Addiko Bank aufgenommen

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

Books josefchladek.com

The Color of Money and Trees

2024

Void

Flowers Drink the River

2024

Stanley / Barker

There is a big river ...

2024

Void

La Mort et les Statues

1946

Editions du Compas

Ken Domon

Ken Domon Joachim Brohm

Joachim Brohm Pierre Jahan

Pierre Jahan Le Corbusier

Le Corbusier