Inbox: Amag und der Megatrend, voestalpine und die Margen, Lenzing Capex

adidas

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.14%

Letzter SK: 220.10 ( 0.73%)

Allianz

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.37%

Letzter SK: 347.70 ( -0.14%)

Amag

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.20%

Letzter SK: 24.60 ( -1.60%)

BMW

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.09%

Letzter SK: 78.48 ( -1.58%)

Continental

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.39%

Letzter SK: 77.10 ( -0.16%)

Deutsche Post

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.59%

Letzter SK: 39.02 ( 0.54%)

Drillisch

Uhrzeit: 22:59:48

Veränderung zu letztem SK: -0.00%

Letzter SK: 18.26 ( 0.22%)

ElringKlinger

Uhrzeit: 22:59:43

Veränderung zu letztem SK: -2.98%

Letzter SK: 4.71 ( -0.53%)

Flughafen Wien

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.18%

Letzter SK: 54.40 ( -0.37%)

Grammer

Uhrzeit: 22:58:18

Veränderung zu letztem SK: 0.34%

Letzter SK: 7.40 ( 0.00%)

Hannover Rück

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.54%

Letzter SK: 277.20 ( -0.07%)

Lanxess

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.07%

Letzter SK: 27.22 ( 0.07%)

Lenzing

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.57%

Letzter SK: 26.40 ( -3.83%)

Mayr-Melnhof

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.07%

Letzter SK: 74.80 ( -0.40%)

Mercedes-Benz Group

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.43%

Letzter SK: 52.78 ( -0.42%)

Österreichische Post

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.08%

Letzter SK: 30.05 ( -0.83%)

S Immo Letzter SK: 30.05 ( 0.00%)

SBO

Uhrzeit: 22:59:44

Veränderung zu letztem SK: -0.00%

Letzter SK: 30.55 ( -0.81%)

Strabag

Uhrzeit: 23:00:27

Veränderung zu letztem SK: 0.00%

Letzter SK: 77.50 ( -0.26%)

Symrise

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 1.08%

Letzter SK: 104.00 ( -0.14%)

UBM

Uhrzeit: 23:00:23

Veränderung zu letztem SK: -0.88%

Letzter SK: 19.80 ( -1.98%)

voestalpine

Uhrzeit: 23:00:23

Veränderung zu letztem SK: -0.35%

Letzter SK: 23.18 ( -1.28%)

Volkswagen

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.44%

Letzter SK: 97.60 ( -0.61%)

Williams Grand Prix Letzter SK: 97.60 ( 0.00%)

23.09.2016

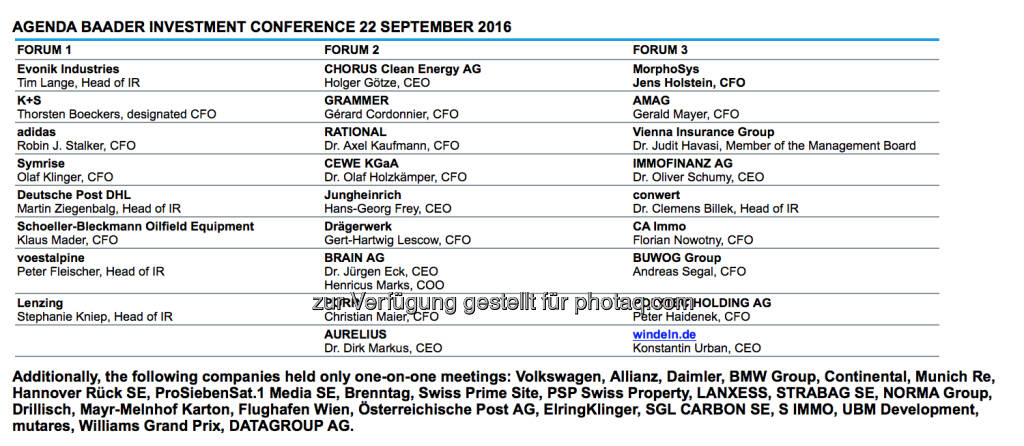

Zugemailt von / gefunden bei: Baader Bank (BSN-Hinweis: Lauftext im Original des Aussenders, Titel (immer) und Bebilderung (oft) durch boerse-social.com aus dem Fotoarchiv von photaq.com)

Companies stay convinced to weather potential challenges!

The 5th Baader Investment Conference that we hosted in Munich had a successful conclusion yesterday. On the final day of our 3-day event, 26 companies held presentations. In addition, we arranged again roughly 350 individual and small-group meetings between investors and 51 companies.

Most companies presenting at our conference were confident to reach their targets for growth and profitability. As an example, both adidas and Jungheinrich fully reiterated the recently increased FY16 guidance. Deutsche Post DHL confirmed both the long-standing targets set out for this year and also the guidance for 2020. GRAMMER was confident to be well on track reaching both the 5% EBIT margin target for FY17 and its revenue goals for 2020. Also Symrise fully reiterated its FY16 and medium-term group guidance.

Regarding the pillars of this optimism, several corporates highlighted the strong support coming from a business model geared to megatrends. As an example, AMAG saw an ongoing strong demand towards aluminum products driven by the trend towards light-weight fabrication, while BRAIN seemed well-placed to benefit from the sector trend towards white biotech. On top, the strong position as a market leader was an important growth driver cited by companies such as Rational and CEWE.

Against this backdrop, most companies saw themselves well-prepared to digest temporary headwinds quite well. While SBO so far was not experiencing a demand uptick in the oil & gas business, K+S was optimistic that strain factors would ease moving forward following a weak second quarter in both business units. voestalpine projected higher margins over the next few quarters as rising steel prices became effective in new contracts. Despite the ongoing tailwind from viscose pricing, Lenzing could see temporary burdens coming from higher capex needs related to a new TENCEL plant and a potential increase of backward integration.

Additionally, the following companies held only one-on-one meetings: Volkswagen , Allianz , Daimler , BMW Group, Continental , Munich Re, Hannover Rück SE, ProSiebenSat.1 Media SE, Brenntag, Swiss Prime Site, PSP Swiss Property, LANXESS , STRABAG SE, NORMA Group, Drillisch , Mayr-Melnhof Karton, Flughafen Wien , Österreichische Post AG, ElringKlinger , SGL CARBON SE, S IMMO, UBM Development, mutares, Williams Grand Prix, DATAGROUP AG.

Companies im Artikel

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (14.03.2015)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

4279

amag_und_der_megatrend_voestalpine_und_die_margen_lenzing_capex

Aktien auf dem Radar:Strabag, Austriacard Holdings AG, Verbund, Addiko Bank, EuroTeleSites AG, Flughafen Wien, RBI, ATX Prime, Pierer Mobility, VIG, Warimpex, Zumtobel, Porr, EVN, AT&S, Gurktaler AG Stamm, Lenzing, Polytec Group, Marinomed Biotech, Oberbank AG Stamm, Amag, FACC, OMV, Palfinger, Österreichische Post, Telekom Austria, Uniqa.

(BSN-Hinweis: Lauftext im Original des Aussenders, Titel (immer) und Bebilderung (oft) durch boerse-social.com aus dem Fotoarchiv von photaq.com)128366

inbox_amag_und_der_megatrend_voestalpine_und_die_margen_lenzing_capex

Random Partner #goboersewien

UBM

Die UBM fokussiert sich auf Immobilienentwicklung und deckt die gesamte Wertschöpfungskette von Umwidmung und Baugenehmigung über Planung, Marketing und Bauabwicklung bis zum Verkauf ab. Der Fokus liegt dabei auf den Märkten Österreich, Deutschland und Polen sowie auf den Asset-Klassen Wohnen, Hotel und Büro.

>> Besuchen Sie 60 weitere Partner auf boerse-social.com/goboersewien

Inbox: Amag und der Megatrend, voestalpine und die Margen, Lenzing Capex

23.09.2016, 12126 Zeichen

23.09.2016

Zugemailt von / gefunden bei: Baader Bank (BSN-Hinweis: Lauftext im Original des Aussenders, Titel (immer) und Bebilderung (oft) durch boerse-social.com aus dem Fotoarchiv von photaq.com)

Companies stay convinced to weather potential challenges!

The 5th Baader Investment Conference that we hosted in Munich had a successful conclusion yesterday. On the final day of our 3-day event, 26 companies held presentations. In addition, we arranged again roughly 350 individual and small-group meetings between investors and 51 companies.

Most companies presenting at our conference were confident to reach their targets for growth and profitability. As an example, both adidas and Jungheinrich fully reiterated the recently increased FY16 guidance. Deutsche Post DHL confirmed both the long-standing targets set out for this year and also the guidance for 2020. GRAMMER was confident to be well on track reaching both the 5% EBIT margin target for FY17 and its revenue goals for 2020. Also Symrise fully reiterated its FY16 and medium-term group guidance.

Regarding the pillars of this optimism, several corporates highlighted the strong support coming from a business model geared to megatrends. As an example, AMAG saw an ongoing strong demand towards aluminum products driven by the trend towards light-weight fabrication, while BRAIN seemed well-placed to benefit from the sector trend towards white biotech. On top, the strong position as a market leader was an important growth driver cited by companies such as Rational and CEWE.

Against this backdrop, most companies saw themselves well-prepared to digest temporary headwinds quite well. While SBO so far was not experiencing a demand uptick in the oil & gas business, K+S was optimistic that strain factors would ease moving forward following a weak second quarter in both business units. voestalpine projected higher margins over the next few quarters as rising steel prices became effective in new contracts. Despite the ongoing tailwind from viscose pricing, Lenzing could see temporary burdens coming from higher capex needs related to a new TENCEL plant and a potential increase of backward integration.

Additionally, the following companies held only one-on-one meetings: Volkswagen , Allianz , Daimler , BMW Group, Continental , Munich Re, Hannover Rück SE, ProSiebenSat.1 Media SE, Brenntag, Swiss Prime Site, PSP Swiss Property, LANXESS , STRABAG SE, NORMA Group, Drillisch , Mayr-Melnhof Karton, Flughafen Wien , Österreichische Post AG, ElringKlinger , SGL CARBON SE, S IMMO, UBM Development, mutares, Williams Grand Prix, DATAGROUP AG.

Companies im Artikel

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (14.03.2015)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

Show latest Report (17.09.2016)

4279

amag_und_der_megatrend_voestalpine_und_die_margen_lenzing_capex

Was noch interessant sein dürfte:

kapitalmarkt-stimme.at daily voice 150/365: Börse Social Magazine 100 mit CCPA, EAM, 2x Raiffeisen, Verbund, Erste Group im Fokus

adidas

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.14%

Letzter SK: 220.10 ( 0.73%)

Allianz

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.37%

Letzter SK: 347.70 ( -0.14%)

Amag

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.20%

Letzter SK: 24.60 ( -1.60%)

BMW

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.09%

Letzter SK: 78.48 ( -1.58%)

Continental

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.39%

Letzter SK: 77.10 ( -0.16%)

Deutsche Post

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.59%

Letzter SK: 39.02 ( 0.54%)

Drillisch

Uhrzeit: 22:59:48

Veränderung zu letztem SK: -0.00%

Letzter SK: 18.26 ( 0.22%)

ElringKlinger

Uhrzeit: 22:59:43

Veränderung zu letztem SK: -2.98%

Letzter SK: 4.71 ( -0.53%)

Flughafen Wien

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.18%

Letzter SK: 54.40 ( -0.37%)

Grammer

Uhrzeit: 22:58:18

Veränderung zu letztem SK: 0.34%

Letzter SK: 7.40 ( 0.00%)

Hannover Rück

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.54%

Letzter SK: 277.20 ( -0.07%)

Lanxess

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.07%

Letzter SK: 27.22 ( 0.07%)

Lenzing

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.57%

Letzter SK: 26.40 ( -3.83%)

Mayr-Melnhof

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.07%

Letzter SK: 74.80 ( -0.40%)

Mercedes-Benz Group

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.43%

Letzter SK: 52.78 ( -0.42%)

Österreichische Post

Uhrzeit: 23:00:23

Veränderung zu letztem SK: 0.08%

Letzter SK: 30.05 ( -0.83%)

S Immo Letzter SK: 30.05 ( 0.00%)

SBO

Uhrzeit: 22:59:44

Veränderung zu letztem SK: -0.00%

Letzter SK: 30.55 ( -0.81%)

Strabag

Uhrzeit: 23:00:27

Veränderung zu letztem SK: 0.00%

Letzter SK: 77.50 ( -0.26%)

Symrise

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 1.08%

Letzter SK: 104.00 ( -0.14%)

UBM

Uhrzeit: 23:00:23

Veränderung zu letztem SK: -0.88%

Letzter SK: 19.80 ( -1.98%)

voestalpine

Uhrzeit: 23:00:23

Veränderung zu letztem SK: -0.35%

Letzter SK: 23.18 ( -1.28%)

Volkswagen

Uhrzeit: 22:59:42

Veränderung zu letztem SK: -0.44%

Letzter SK: 97.60 ( -0.61%)

Williams Grand Prix Letzter SK: 97.60 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:Strabag, Austriacard Holdings AG, Verbund, Addiko Bank, EuroTeleSites AG, Flughafen Wien, RBI, ATX Prime, Pierer Mobility, VIG, Warimpex, Zumtobel, Porr, EVN, AT&S, Gurktaler AG Stamm, Lenzing, Polytec Group, Marinomed Biotech, Oberbank AG Stamm, Amag, FACC, OMV, Palfinger, Österreichische Post, Telekom Austria, Uniqa.

Random Partner

UBM

Die UBM fokussiert sich auf Immobilienentwicklung und deckt die gesamte Wertschöpfungskette von Umwidmung und Baugenehmigung über Planung, Marketing und Bauabwicklung bis zum Verkauf ab. Der Fokus liegt dabei auf den Märkten Österreich, Deutschland und Polen sowie auf den Asset-Klassen Wohnen, Hotel und Büro.

>> Besuchen Sie 60 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX legt am Freitag 0,06 Prozent zu

- Wiener Börse Nebenwerte-Blick: Gurktaler steigt 5...

- Neue Bilder: Börse Social Magazine 100; Christoph...

- Wie Lenzing, AT&S, CPI Europe AG, Bawag, Telekom ...

- Wie Gurktaler AG Stamm, RHI Magnesita, UBM, Warim...

- Österreich-Depots: Ultimo Bilanz, beide über der ...

Featured Partner Video

Erfolge für Ö-Teams

Das Sporttagebuch mit Michael Knöppel - 7. Mai 2025 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch

Das Sporttagebuch mit Michael Knöppel - 7. Mai 2025

E-Mail: sportta...

Books josefchladek.com

I’ll Be Late

2024

Void

Mer

1936

Éditions O.E.T.

There is a big river ...

2024

Void

Cologne intime

1957

Greven

Hessischer Rundfunk. 81 Funkhausbilder.

1964

Hessischer Rundfunk

Daniel Chatard

Daniel Chatard Joachim Brohm

Joachim Brohm Le Corbusier

Le Corbusier Lucas Olivet

Lucas Olivet