21st Austria weekly - Immofinanz, Pierer Mobility, Vienna Stock Exchange (15/03/2024)

17.03.2024, 2544 Zeichen

Immofinanz: Real estate company Immofinanz is selling two office properties in Vienna. The properties in the 20^th district of Vienna have been successfully sold to an Austrian real estate investor. The two office properties in Dresdnerstraße in Vienna’s 20th district offer modern and flexible offices with approximately 13,000 sqm of usable space in the northern business district of Vienna. The properties are fully rented and were sold above carrying amount and in line with Immofinanz’s strategy. “In line with our strategy, we will invest the proceeds from the sale in value-creating purchases of higher yielding properties in our core markets,” says Radka Doehring, member of the Immofinanz Executive Board.

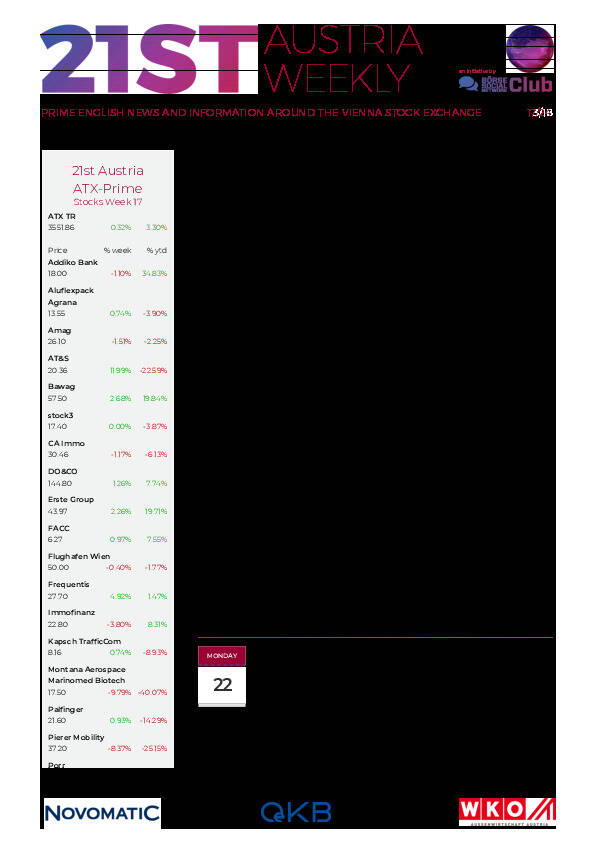

Immofinanz: weekly performance:

Pierer Mobility: The Pierer Mobility group exercised a call option to acquire a majority stake in MV Agusta Motor S.p.A. to 50.1% prematurely. In November 2022, KTM AG, a subsidiary of Pierer Mobility AG, acquired 25.1% of MV Agusta Motor S.p.A., based in Varese (Italy), as part of a capital increase. The call option granted to KTM AG on the basis of the annual financial statements as of December 31, 2025 to acquire a majority stake in MV Agusta Motor S.p.A. will now be exercised prematurely. The purchase price for the remaining 25% of the shares was calculated in accordance with the previously agreed valuation method (EBITDA multiple). This means that KTM AG will take over the majority and also the industrial management of MV Agusta Motor S.p.A. In the medium term, an annual production volume of more than 10,000 MV Agusta premium motorcycles is planned at the site in Varese.

Pierer Mobility: weekly performance:

Vienna Stock Exchange: The Vienna Stock Exchange welcomes Jump Trading Europe B.V. as a new international trading member. Thus, a total number of 70 members, including 21 Austrian and 49 international banks and securities firms, are currently connected to the Viennese trading venue. Jump Trading is a global research and technology-driven trading firm and is represented in Europe with branches in Amsterdam, Bristol, London and Paris. More than 85% of the equity turnover on the Vienna Stock Exchange is generated by international trading members. Most of the turnover originates from Germany (48.6%), France (21%) and Ireland (10,9%). Top trading participants in 2023 included Morgan Stanley & Co, Goldman Sachs and J.P. Morgan Securities.

ATX: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (15/03/2024)

SportWoche Podcast #106: Persönliches Fail-Fazit VCM und Staatsmeisterin Carola Bendl-Tschiedel über Rekordlerin Julia Mayer

Bildnachweis

Aktien auf dem Radar:Immofinanz, Polytec Group, Marinomed Biotech, Flughafen Wien, Warimpex, Lenzing, AT&S, Strabag, Uniqa, Wienerberger, Pierer Mobility, ATX, ATX TR, VIG, Andritz, Erste Group, Semperit, Cleen Energy, Österreichische Post, Stadlauer Malzfabrik AG, Addiko Bank, Oberbank AG Stamm, Agrana, Amag, CA Immo, EVN, Kapsch TrafficCom, OMV, Telekom Austria, Siemens Energy, Intel.

Random Partner

DADAT Bank

Die DADAT Bank positioniert sich als moderne, zukunftsweisende Direktbank für Giro-Kunden, Sparer, Anleger und Trader. Alle Produkte und Dienstleistungen werden ausschließlich online angeboten. Die Bank mit Sitz in Salzburg beschäftigt rund 30 Mitarbeiter und ist als Marke der Bankhaus Schelhammer & Schattera AG Teil der GRAWE Bankengruppe.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten