AT&S grows by double digits in the corona year 2020/21

18.05.2021, 8655 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Annual Result

Leoben -

Record revenue of EUR 1,188.2 million (+18.8%), 23% revenue increase in Q4\nDemand for ABF substrates continues unabated\nProduction start at plant III in Chongqing to be brought forward - ramp-up in the current financial year\nEBITDA of EUR 245.7 million nearly at historic high, EBITDA margin improved from 19.4% to 20.7%\nOutlook 2021/22: revenue growth of 13 to 15%, adjusted EBITDA margin in the range from 21 to 23%\nAT&S closed a challenging year - marked by the corona pandemic - with an impressive performance and achieved a double-digit increase in revenue and earnings.

"With this performance, we have once again proven our resilient business model and demonstrated that we continuously develop even in times of uncertainty. We are growing faster than the market while being highly profitable. In the past, we created the basis that enables us to respond quickly and consistently work on advancing our growth strategy at the same time. We are fully on track to achieve our goals," says CEO Andreas Gerstenmayer.

Consolidated revenue was at a record level of EUR 1,188.2 million (PY: EUR 1,000.6 million), up 19% year-on-year. Adjusted for currency effects, consolidated revenue even rose by 22%. The additional capacity from the Chongqing I plant, which serves the growing demand for ABF substrates, made a significant contribution to revenue growth. In the Mobile Devices & Substrates segment, the broader customer and application portfolio for mobile devices and demand for printed circuit boards for modules also had a positive effect. In the AIM segment, revenue in the Medical segment was at the prior-year level while revenue in the Industrial segment increased slightly. After a weak first half of the financial year, the Automotive segment recorded revenue in the second half at the level of the previous year.

EBITDA amounted to EUR 245.7 million (PY: EUR 194.5 million) and nearly matched the historic high of the financial year 2018/19. The earnings improvement is predominantly attributable to the higher consolidated revenue. Currency effects, in particular due to the weaker US dollar, had a negative impact on the revenue and earnings development. The EBITDA margin amounted to 20.7%, thus exceeding the prior-year level of 19.4%. EBIT improved from EUR 47.4 million to EUR 79.8 million. The EBIT margin was at 6.7% (previous year: 4.7%).

Finance cost - net changed from EUR -8.7 million to EUR -20.1 million primarily due to currency effects. Net profit for the year rose from EUR 19.8 million in the previous year to EUR 47.4 million as a result of the significant increase in the operating result.

The financial position at year-end is characterised by the increase in non- current assets. Total assets rose by 28.9% year-on-year to EUR 2,390.0 million as a result of additions to assets and technology upgrades. Equity increased by 5.5% year-on-year and amounted to EUR 802.0 million, primarily due to the increase in net profit for the year. The equity ratio declined from 41.0% in the previous year to 33.6% in the reporting year and fell short of the medium-term target of 40.0%. This is attributable in particular to the increase in total assets as a result of investments and securing the financing of the future investment programme.

Cash and cash equivalents rose to EUR 552.9 million (PY: EUR 418.0 million). In addition, AT&S has financial assets of EUR 39.7 million and unused credit lines of EUR 418.6 million to ensure financing of the future investment programme and short-term repayments.

"AT&S is economically stable and has a solid balance sheet structure, which was further strengthened by capital measures in the past year. To secure financing of the upcoming investments and ongoing business activities, we will continue to optimise and expand our capital structure," says CFO Simone Faath.

Key figures Unit 2019/20 2020/21 Change in% Revenue EUR million 1,000.6 1,188.2 18.8% EBITDA EUR million 194.5 245.7 26.3% EBITDA margin % 19.4% 20.7% - EBIT EUR million 47.4 79.8 68.3% EBIT margin % 4.7% 6.7% - Profit for the EUR million 19.8 *) 47.4 >100% period ROCE % 2.8% 5.8% - Net CAPEX EUR million 218.5 435.8 99.4% Cash flow from operating EUR million 185.1 184.7 (0.3%) activities Net debt EUR million 246.7 508.5 >100% Earnings/share EUR 0.30 1.01 >100% Dividend EUR 0.25 0.39 **) 56.0% Number of employees - 10,239 11,349 15.0% (average)

*) Adjustment hedge accounting previous year **) Proposal to the Annual General Meeting

Outlook 2021/22 The global trend towards a digital society will continue to progress in the financial year 2021/22. The use of ever smarter devices, i.e. devices equipped with intelligence, and increasing interconnection are generating exponential data volume growth. With its solutions and services, AT&S is excellently positioned in all market segments affected by this development. AT&S will exploit the business opportunities arising from this development in order to grow profitably and faster than the market in the future. To enhance our performance, we consistently invest large sums in technology and capacity expansion. Our long-term corporate goals reflect our clear growth ambitions in profitable market segments and applications.

The positive outlook of the electronics industry is currently dampened by a shortage of semiconductors. The expectations for AT&S's segments are currently as follows: the persisting strong demand for IC substrates continues to offer significant growth opportunities in the medium term. The 5G mobile communication standard will continue to drive growth in the area of Mobile Devices. An upturn is expected in the Automotive segment despite the semiconductor shortage. Driven by a boom in industrial robots and the roll-out of the 5G infrastructure, the Industrial segment will continue to see a positive development in the coming year. AT&S expects a positive development in the Medical segment for the current financial year.

Operationally, AT&S will concentrate on the start-up of the new production capacities at plant III in Chongqing, carry out technology upgrades at other locations and continue to drive its business performance.

Investments "The market for communication infrastructure, which is responsible for data transmission, is booming and so is demand for processing capacity. Digitisation in all areas of life will continue to develop dynamically. Therefore, we are investing in additional capacity and are significantly expanding our market position of ABF substrates," says Andreas Gerstenmayer.

Up to EUR 100 million is budgeted for basic investments (maintenance and technology upgrades) depending on market development. As part of the strategic projects, the management is planning investments totalling up to EUR 450 million for the financial year 2021/22 depending on the progress of projects, plus another EUR 80 million due to period shifts between the financial years.

Guidance for the financial year 2021/22 Against the background of the expectations for global economic growth, of the available capacities and the markets relevant to AT&S as described above, the company expects revenue growth of 13 to 15% in the financial year 2021/22, assuming a euro/US dollar exchange rate of 1.18. Taking into account special effects amounting to approximately EUR 40 million from the start-up of new production capacities in Chongqing, the adjusted EBITDA margin is expected to range between 21 and 23%.

end of announcement euro adhoc

issuer: AT & S Austria Technologie & Systemtechnik Aktiengesellschaft Fabriksgasse 13 A-8700 Leoben phone: 03842 200-0 FAX: mail: ir@ats.net WWW: www.ats.net ISIN: AT0000969985 indexes: ATX, VÖNIX, ATX GP, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/18136/aom

ABC Audio Business Chart #102: Nettolöhne und Arbeitskosten in Europa (Josef Obergantschnig)

AT&S

Uhrzeit: 10:26:26

Veränderung zu letztem SK: 0.48%

Letzter SK: 21.00 ( 3.14%)

Bildnachweis

1.

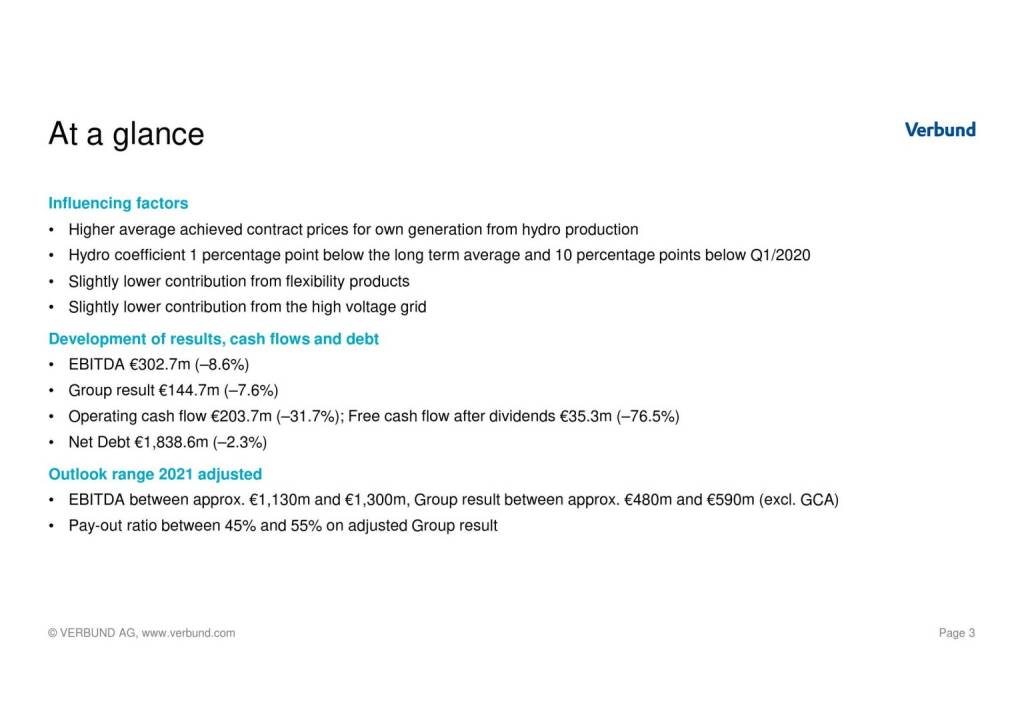

Verbund - At a glance

>> Öffnen auf photaq.com

Aktien auf dem Radar:Polytec Group, Immofinanz, Marinomed Biotech, Austriacard Holdings AG, Flughafen Wien, Warimpex, AT&S, Strabag, Uniqa, Wienerberger, EVN, Erste Group, Österreichische Post, ams-Osram, Josef Manner & Comp. AG, Wiener Privatbank, Addiko Bank, Oberbank AG Stamm, BKS Bank Stamm, Agrana, Amag, CA Immo, Kapsch TrafficCom, OMV, Telekom Austria, VIG, Deutsche Bank, Vonovia SE, Siemens Energy, RWE, Airbus Group.

Random Partner

Matejka & Partner

Die Matejka & Partner Asset Management GmbH ist eine auf Vermögensverwaltung konzentrierte Wertpapierfirma. Im Vordergrund der Dienstleistungen stehen maßgeschneiderte Konzepte und individuelle Lösungen. Für die Gesellschaft ist es geübte Praxis, neue Herausforderungen des Marktes frühzeitig zu erkennen und entsprechende Strategien zu entwickeln.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2H9F5 | |

| AT0000A2C5F8 | |

| AT0000A2SUY6 |

- Marktkapitalisierung der 100 wertvollsten globale...

- wikifolio Champion per ..: Jörn Remus mit Nordstern

- Börsenkandidat ASTA erweitert Geschäftsfeld

- DAX-Frühmover: Vonovia SE, Mercedes-Benz Group, V...

- Fielmann, Deutsche Wohnen am besten (Peer Group W...

- ATX TR-Frühmover: OMV, Erste Group, DO&CO, Mayr-M...

Featured Partner Video

SportWoche Podcast #103: creAgency als Partner des Sportgeschichte-Projekts für Österreich, das am 11. April 2024 startet

In Folge #103 oute ich die Partner des Sportgeschichte-Projekts neu, das am 11. April live gehen wird. Es sind die Christoph Vetchy (am Icon links) und Florian Kott

Books josefchladek.com

Körpersplitter

1980

Veralg Droschl

Forage

2023

Void

Bonifica

2024

Self published

Kristina Syrchikova

Kristina Syrchikova Helen Levitt

Helen Levitt Igor Chekachkov

Igor Chekachkov Futures

Futures Dominic Turner

Dominic Turner Kurama

Kurama