Kapsch TrafficCom AG / Results for the first three quarters of 2019/20.

18.02.2020, 8466 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Financial Figures/Balance Sheet

Vienna - Highlights.

Revenues increased to EUR 545.5 million (+2%).\nEBIT dropped to EUR 7.7 million (previous year: EUR 33.6 million).\nOne-off effects of EUR 10.6 million weigh on the EBIT.\n"The results have not met my expectations or what we have aimed for. We are currently experiencing a certain amount of upheaval as we move into a new phase of expansion. The business model is being extended in a way to address both existing and new customer groups with innovative solutions. The necessary investments have a direct influence on our profit and loss statement as we do not capitalize much.

We will continue working purposefully. As soon as we have succeeded in rebuilding a solid staffing level in North America and recovered the usual high productivity we are accustomed to, as well as overcome the challenges in Africa, we will be able to enjoy profitable growth again," says Georg Kapsch, CEO of Kapsch TrafficCom.

Unless otherwise stated, all values Q1-Q3 2018/19 Q1-Q3 2019/20 +/- in EUR million Revenues 533.1 545.5 2.3% EBIT 33.6 7.7 -77.2% EBIT margin 6.3% 1.4% -4.9% Profit for the 21.9 0.2 -99.3% period Earnings per share 1.77 0.14 -91.9% (EUR)

Vienna, February 18, 2020 - Kapsch TrafficCom was able to increase the revenues of the first three quarters 2019/20 to EUR 545.5 million (+2.3%). Growth in the Americas region (North, Central and South America) was particularly noteworthy (+23.2%). The operating result (EBIT) reached EUR 7.7 million (-77.2%), corresponding to an EBIT margin of 1.4% (previous year: 6.3%). EUR 10.6 million of one-off effects weighed on the EBIT: EUR 5.9 million related to the German infrastructure charge topic, EUR 2.3 million to the ending of operations of the nation-wide toll system in Czech Republic, and EUR 2.4 to end Streetline's business activities (smart on-street parking solutions).

The lower profitability has to do with the growth of the North American business, among others. It has turned out to be more difficult than expected to recruit a sufficient number of new employees. In the first nine months of the year, we adopted a new recruiting strategy and were able to increase the number of employees in the USA (excluding the smart parking subsidiary Streetline) by around 110 to a total of 753. It should not be forgotten that the many new employees must often be trained by experienced colleagues. This means that productivity will fall and costs increase before it is possible to achieve the full potential of the expanded team. This must be partly compensated by outsourcing. It is therefore understandable that profitability of the Group will suffer temporarily. This situation will likely continue until well into financial year 2020/21. The number of employees should then reach a stable level and continue to grow at a "healthy" rate.

In Zambia, regulatory issues persist.To limit the risk, Kapsch TrafficCom reduced its activities to a minimum a while ago

Kapsch TrafficCom is not aware of any company that has been able to demonstrate a sustainable and profitable business model in the area of smart on-street parking and curb management. This also applies to the Group company Streetline. Therefore, the management has decided to end the business activities of this company.

The financial result of EUR -5.2 million was EUR 2.9 million below the previous year's figure. The latter included a positive one-off effect in the amount of EUR 5.1 million from the sale of the stake in ParkJockey.

The profit for the period amounted to EUR 0.2 million (previous year: EUR 21.9 million), which corresponds to earnings per share of EUR 0.14 (previous year: EUR 1.77).

At EUR -19.8 million, free cash flow was much better than in the comparative period of the previous year (EUR -27.7 million). Net debt increased to EUR 190.2 million (March 31, 2019: net debt of EUR 73.5 million). Without the initial application of IFRS 16, it would have been EUR 125.2 million. The equity ratio was still satisfactory at 31.2% (March 31, 2019: 38.2%).

The departure of the United Kingdom from the EU (Brexit), which has now actually taken place, should have no significant impact on results for Kapsch TrafficCom, as the local revenues there are in the single-digit million range.

Segment results. In the first three quarters of 2019/20, 77.0% of revenue was generated by the ETC segment and 23.0% by the IMS segment. 56.2% of revenue was generated in the Europe, Middle East, and Africa (EMEA) region, 39.4% in the Americas region (North, Central, and South America), and 4.4% in the Asia-Pacific (APAC) region.

ETC (Electronic Toll Collection).

Unless otherwise stated, all values Q1-Q3 2018/19 Q1-Q3 2019/20 +/- in EUR million Revenues 406.9 420.1 3.2% EBIT 40.3 18.5 -54.0% EBIT margin 9.9% 4.4% -5.5%

Revenues in the "Electronic Toll Collection" (ETC) segment saw an increase of 3.2% to EUR 420.1 million. The driver was growth in the Americas region (+31.9%). In the EMEA region, revenues fell by 3.7%. Growth in the areas of implementation and components were not able to compensate for the decline in the area of operations. In the APAC region, revenues came down from EUR 35.0 million to EUR 18.6 million.

ETC EBIT was EUR 18.5 million (-54.0%). The EBIT margin reached 4.4% (previous year: 9.9%).

IMS (Intelligent Mobility Solutions).

Unless otherwise stated, all values Q1-Q3 2018/19 Q1-Q3 2019/20 +/- in EUR million Revenues 126.1 125.3 -0.6% EBIT -6.7 -10.9 -61.6% EBIT margin -5.3% -8.7% -3.3%

In the first three quarters of 2019/20, segment revenues reached EUR 125.3 million (-0.6%). Revenues grew by 3.1% in the Americas and fell by 8.2% in the EMEA. In the APAC region, Kapsch TrafficCom increased IMS revenues strongly, starting from a low level.

The IMS EBIT was EUR -10.9 million and thus below the value of the previous year (EUR -6.7 million).

The highlights report of the first three quarters 2019/20 will be available at http://kapsch.net/ktc/ir [http://kapsch.net/ktc/ir] from today at 7:35 am (CET).

Kapsch TrafficCom is a provider of intelligent transportation systems in the fields of tolling, traffic management, smart urban mobility, traffic safety and security, and connected vehicles. As a one-stop solutions provider, Kapsch TrafficCom offers end-to-end solutions covering the entire value creation chain of its customers, from components and design to the implementation and operation of systems. The mobility solutions supplied by Kapsch TrafficCom help make road traffic safer and more reliable, efficient, and comfortable in urban areas and on highways while helping to reduce pollution. Kapsch TrafficCom is an internationally renowned provider of intelligent transportation systems thanks to the many projects it has brought to successful fruition in more than 50 countries around the globe. As part of the Kapsch Group, Kapsch TrafficCom with headquarters in Vienna, has subsidiaries and branches in more than 30 countries. It has been listed in the Prime Market of the Vienna Stock Exchange since 2007 (ticker symbol: KTCG). Kapsch TrafficCom's about 5,000 employees generated revenues of EUR 738 million in financial year 2018/19.

end of announcement euro adhoc

Attachments with Announcement: ---------------------------------------------- http://resources.euroadhoc.com/documents/2235/5/10407404/1/KTC_Press_Release_Q1-Q3_2019_20.pdf

issuer: Kapsch TrafficCom AG Am Europlatz 2 A-1120 Wien phone: +43 50811 1122 FAX: +43 50811 99 1122 mail: ir.kapschtraffic@kapsch.net WWW: www.kapschtraffic.com ISIN: AT000KAPSCH9 indexes: stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/411/aom

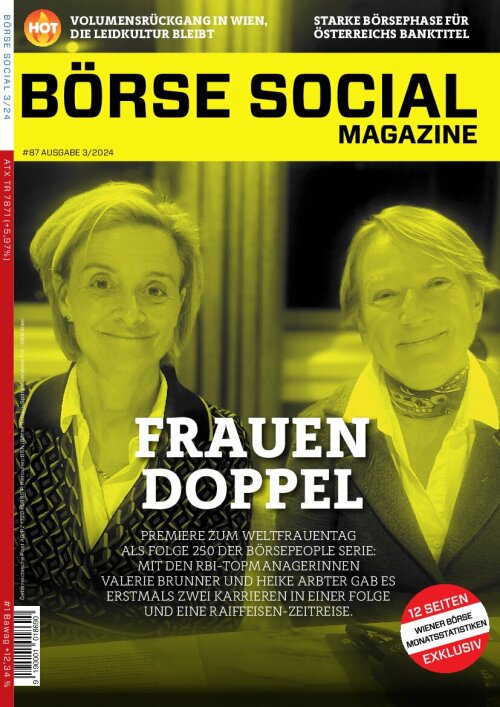

Börsepeople im Podcast S12/13: Carola Bendl-Tschiedel

Kapsch TrafficCom

Uhrzeit: 10:09:21

Veränderung zu letztem SK: 0.12%

Letzter SK: 8.14 ( 1.75%)

Bildnachweis

1.

Kapsch TrafficCom - Die weltweiten Büros von Kapsch TrafficCom

>> Öffnen auf photaq.com

Aktien auf dem Radar:Polytec Group, Immofinanz, Palfinger, Warimpex, Flughafen Wien, Austriacard Holdings AG, EVN, Rosgix, S Immo, Erste Group, Österreichische Post, Cleen Energy, Marinomed Biotech, Pierer Mobility, RBI, Addiko Bank, SW Umwelttechnik, Oberbank AG Stamm, Agrana, Amag, CA Immo, Kapsch TrafficCom, OMV, Telekom Austria, Uniqa, VIG, Wienerberger, Mercedes-Benz Group, Siemens Energy, Deutsche Post, Allianz.

Random Partner

VIG

Die Vienna Insurance Group (VIG) ist mit rund 50 Konzerngesellschaften und mehr als 25.000 Mitarbeitern in 30 Ländern aktiv. Bereits seit 1994 notiert die VIG an der Wiener Börse und zählt heute zu den Top-Unternehmen im Segment “prime market“ und weist eine attraktive Dividendenpolitik auf.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A38NH3 | |

| AT0000A36XA1 | |

| AT0000A2STY8 |

- wikifolio whispers a.m. Nordex; Starbucks; Caterp...

- DAX-Frühmover: Bayer, Infineon, RWE, Deutsche Ban...

- Fielmann, BB Biotech am besten (Peer Group Watch ...

- ATX TR-Frühmover: OMV, Bawag, SBO, AT&S, Wienerbe...

- Neue Kursziele für Polytec, Palfinger, Erste Grou...

- wikifolio Champion per ..: Jörn Remus mit Nordstern

Featured Partner Video

Börsepeople im Podcast S12/13: Carola Bendl-Tschiedel

Carola Bendl-Tschiedel ist Non-Financial Risk Lead bei der bank99 und amtierende Staatsmeisterin im Marathon. Wir beginnen mit dem Sport, weil ihr Staatsmeistertitel erst wenige Wochen her ist und ...

Books josefchladek.com

Misplacements

2023

Self published

NA4JOPM8

2021

ist publishing

Bolnichka (Владислава Краснощока

2023

Moksop

False friends

2023

Self published

Index Naturae

2023

Skinnerboox

Sebastián Bruno

Sebastián Bruno Ed van der Elsken

Ed van der Elsken Christian Reister

Christian Reister Christian Reister

Christian Reister