CEE: Serbia - Inflation has been well anchored and growth picked up in Q3 (Martin Ertl)

- Inflation has been well anchored and growth picked up in Q3 while the real yield in Serbia is already very low.

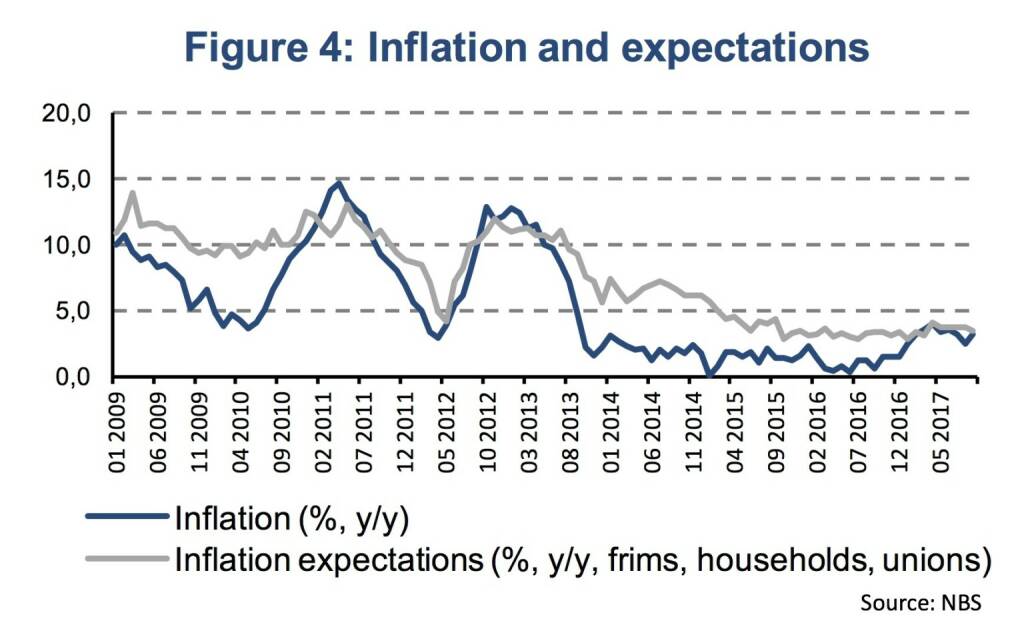

At the monetary policy meeting that took place last on Thursday 9th November, the executive board of the National Bank of Serbia (NBS) decided to keep the key policy rate on hold at 3.5 %. Previously, the NBS had lowered the policy rate twice this year by 25 basis points in September and October. The executive boards assessed that inflationary pressures remain low. In September, the inflation rate was 3.2 % (y/y) and lower than previously expected. The drought effects on food prices were weaker than expected. In addition, domestic inflation expectations seem to adjust to a lower level (Figure 4).

The real, inflation-adjusted interest rate has also reached a low (< 1 % on average) this year. The NBS expects inflation to continue moving within the target tolerance band (3.0 % +/- 1.5 percentage points) in the coming months and to be at a lower level in H1 2018 due to high base effects from the prices of petroleum and other products that underwent one-off price hikes early in this year. The expected rise in the prices of non-processed agricultural products and aggregate demand will act in the opposite direction.

Growth firmed in the third quarter of 2017. Real GDP increased by 2.1 % (y/y) after expanding on average by 1.2 % in H1 2017. Industrial production including manufacturing picked up rising by 6.3 and 7.3 % (y/y) on average in Q3. Monthly retail sales increased by 3.7 % during the third quarter.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

Latest Blogs

» BSN Spitout Wiener Börse: Erste Group über...

» Österreich-Depots: Weekend-Bilanz (Depot K...

» Börsegeschichte 19.4.: Rosenbauer (Börse G...

» Aktienkäufe bei Porr und UBM, News von VIG...

» Nachlese: Warum CA Immo, Immofinanz und RB...

» Wiener Börse Party #633: Heute April Verfa...

» Wiener Börse zu Mittag schwächer: Frequent...

» Börsenradio Live-Blick 19/4: DAX eröffnet ...

» SportWoche Party 2024 in the Making, 19. A...

» Börse-Inputs auf Spotify zu u.a. Sartorius...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...