AGRANA profit jumps in first quarter of 2017|18

13.07.2017, 6624 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

EBIT surge of 48.5%\nOutlook for full 2017|18 financial year: Expecting significant increase in EBIT and moderate growth in revenue\nQuarterly Report/Financial Figures 1st Quarter

Wien - AGRANA, the global sugar, starch and fruit products manufacturer, kicked off the 2017|18 financial year with a strong rise in EBIT. The Group's revenue increased slightly to EUR 684.2 million in the first quarter ended 31 May 2017, up 2.8% from the first three months of the prior year. EBIT, at EUR 69.8 million, was up by a compelling 48.5% from the year-earlier quarter. The growth in the Group's EBIT was driven especially by the very positive ethanol price trend in the Starch segment, but also by better earnings in the Sugar segment. In the Fruit segment as well, EBIT exceeded the year-ago level.

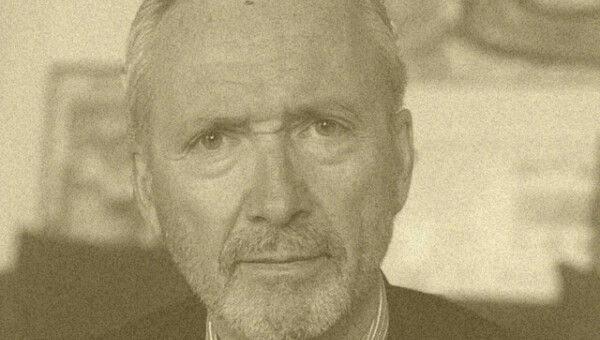

"The good start to this financial year, which surpassed our already optimistic initial expectations for the first quarter, recently allowed us to raise our guidance for the full year. We are also pleased that all three business segments are contributing to this good performance," AGRANA Chief Executive Officer Johann Marihart sums up the financial year to date.

AGRANA Group financial results

EUR million, except %

Q1 2017|18 Q1 2016|17 Revenue 684.2 665.5 EBITDA* 77.6 58.1 Operating profit (EBIT) 69.8 47.0 EBIT margin 10.2% 7.1% Net financial items (4.8) (7.5) Income tax (14.1) (8.7) Profit for the period 50.9 30.8 Investment** 21.5 18.6

*EBITDA represents operating profit before exceptional items, results of equity- accounted joint ventures, depreciation and amortisation. **Investment represents purchases of property, plant and equipment and intangible assets, excluding goodwill.

Net financial items in the first quarter of 2017|18 amounted to a net expense of EUR 4.8 million (Q1 prior year: net expense of EUR 7.5 million); the improvement, which came despite a deterioration in currency impacts, resulted from the base effect of a prior-year impairment charge on a current finance receivable in Ukraine in the Fruit segment. After an income tax expense of EUR 14.1 million, corresponding to a tax rate of approximately 21.7% (Q1 prior year: 22.0%), profit for the period was EUR 50.9 million (Q1 prior year: EUR 30.8 million). Earnings per share attributable to AGRANA shareholders increased to EUR 3.16 (Q1 prior year***: EUR 2.07). Total assets eased moderately from the 2016|17 year-end balance sheet date to EUR 2.35 billion (28 February 2017: EUR 2.48 billion) and the equity ratio was up by 5 percentage points to 61.9% (28 February 2017: 56.9%). Net debt as of 31 May 2017 stood at EUR 262.6 million, up by EUR 22.7 million from the 2016|17 year-end level. The gearing ratio rose accordingly to 18.0% as of the quarterly balance sheet date (28 February 2017: 17.0%).

*** In the prior year, earnings per share were still calculated on the basis of the 14,202,040 shares outstanding at that time (number of shares outstanding at 31 May 2017: 15,622,244).

Sugar segment

Q1 2017|18 Q1 2016|17 Revenue 178.4 178.4 Operating profit (EBIT) 18.1 10.0 EBIT margin 10.2% 5.6%

The Sugar segment's revenue in the first financial quarter was in line with one year earlier. While a positive effect came from a year-on-year rise in sugar prices, sugar sales quantities were down. The accompanying higher contribution margins were the key reason for the significant increase in EBIT.

Starch segment

Q1 2017|18 Q1 2016|17 Revenue 194.8 179.4 Operating profit (EBIT) 26.6 13.8 EBIT margin 13.7% 7.7%

Starch segment revenue rose by 8.6% in the first quarter. The growth compared with the year-ago quarter resulted mainly from higher bioethanol prices and an increase in sales volumes of starches. EBIT of EUR 26.6 million represented a near-doubling from one year earlier, driven primarily by the high bioethanol quotations.

Fruit segment

Q1 2017|18 Q1 2016|17 Revenue 311.0 307.7 Operating profit (EBIT) 25.1 23.2 EBIT margin 8.1% 7.5%

Fruit segment revenue rose slightly by 1.1% from the first quarter of the prior year. In the fruit preparations business, stable sales volumes and favourable currency effects (notably in Eastern Europe, the USA, Brazil and South Korea) were responsible for the revenue growth. In the fruit juice concentrate operations, revenue decreased from the year-earlier quarter, as a result of lower raw material prices and the associated reduction in concentrate prices for product from the 2016 crop compared to 2015. EBIT of the Fruit segment overall grew by 8.2% from the prior year's comparative period. Both the fruit juice concentrate business (partly through volume and margin growth in beverage bases) and the fruit preparations business contributed to the earnings improvement.

Outlook AGRANA currently expects Group revenue to increase moderately for the 2017|18 financial year, with significant growth in operating profit (EBIT). Total investment by the Group in the year, at about EUR 140 million, will significantly exceed depreciation of approximately EUR 96 million.

About AGRANA AGRANA converts agricultural raw materials into high-quality foods and numerous industrial intermediate products. About 8,600 employees at 55 production sites worldwide generate annual Group revenue of around EUR 2.6 billion. Established in 1988, the company today is the leading sugar producer in Central and Eastern Europe and its Starch segment is a major European manufacturer of custom starch products and bioethanol. AGRANA is also the world market leader in fruit preparations and the largest manufacturer of fruit juice concentrates in Europe.

This announcement is available in German and English at www.agrana.com [http:// www.agrana.com/].

end of announcement euro adhoc

Attachments with Announcement:

---------------------------------------------- http://resources.euroadhoc.com/documents/2118/5/10028852/1/PA_Q1_2017_18_E_end.pdf

issuer: AGRANA Beteiligungs-AG F.-W.-Raiffeisen-Platz 1 A-1020 Wien phone: +43-1-21137-0 FAX: +43-1-21137-12926 mail: info.ab@agrana.com WWW: www.agrana.com ISIN: AT0000603709 indexes: WBI stockmarkets: Stuttgart, Frankfurt, Berlin, Wien language: English

Digital press kit: http://www.ots.at/pressemappe/4/aom

Wiener Börse Party #653: ATX TR Pfingstmontag erneut auf Rekord, den DAX year to date überholt, Tipp von Andi Gross für Agrana

Agrana

Uhrzeit: 13:07:35

Veränderung zu letztem SK: 1.47%

Letzter SK: 13.60 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:E.ON .

Random Partner

Fabasoft

Fabasoft ist ein europäischer Softwarehersteller und Cloud-Anbieter. Das Unternehmen digitalisiert und beschleunigt Geschäftsprozesse, sowohl im Wege informeller Zusammenarbeit als auch durch strukturierte Workflows und über Organisations- und Ländergrenzen hinweg. Der Konzern ist mit Gesellschaften in Deutschland, Österreich, der Schweiz, Großbritannien und den USA vertreten.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A39G83 | |

| AT0000A347X9 | |

| AT0000A37NX2 |

- Wiener Börse Party #653: ATX TR Pfingstmontag ern...

- Börsenradio Live-Blick 20/5: DAX Pfingstmontag s...

- Wiener Börse am Feiertag Vormittag stärker: Agran...

- wikifolio Champion per ..: Richard Dobetsberger m...

- ATX TR-Frühmover: voestalpine, SBO, DO&CO, Österr...

- DAX-Frühmover: Bayer, MTU Aero Engines, Zalando, ...

Featured Partner Video

Börsepeople im Podcast S12/12: Klaus Rainer Kirchhoff

Klaus Rainer Kirchhoff ist seit 30 Jahren mit Kirchhoff Consult und einem Team von aktuell 60 Expertinnen und Experten in den Bereichen Capital Markets, Corporate Communications und Sustainability ...

Books josefchladek.com

Twenty-one Years in One Second

2015

Peperoni Books

Spurensuche 2023

2023

Self published

Misplacements

2023

Self published

Federico Renzaglia

Federico Renzaglia Andreas H. Bitesnich

Andreas H. Bitesnich Tommaso Protti

Tommaso Protti Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Igor Chekachkov

Igor Chekachkov Eron Rauch

Eron Rauch Carlos Alba

Carlos Alba