EANS-Voting Rights: AGRANA Beteiligungs-AG / Publication of an Announcement according to art. 93 BörseG with the objective of Europe-web publication

07.02.2017, 10181 Zeichen

Notification of voting rights transmitted by euro adhoc. The issuer is responsible for the content of this announcement.

Release according to article 93 BörseG with the aim of a Europe-wide distribution

AGRANA Beteiligungs-Aktiengesellschaft (AGRANA), Vienna, ISIN AT0000603709, notifies pursuant to section 93 para 2 BörseG that AGRANA has been informed on 6 February 2017 and 7 February 2017 by RAIFFEISEN-HOLDING NIEDERÖSTERREICH-WIEN registrierte Genossenschaft mit beschränkter Haftung (RHO), "LAREDO" Beteiligungs GmbH (LAREDO), "ALMARA" Holding GmbH (ALMARA), LEIPNIK-LUNDENBURGER INVEST Beteiligungs Aktiengesellschaft (LLI), Marchfelder Zuckerfabriken Gesellschaft m.b.H. (MZ), Estezet Beteiligungsgesellschaft m.b.H. (Estezet), Zucker-Beteiligungsgesellschaft m.b.H. (ZBG), Süddeutsche Zuckerrübenverwertungs-Genossenschaft eG (SZVG), Südzucker AG (Südzucker), AGRANA Zucker, Stärke und Frucht Holding AG (ABH) and Z&S Zucker und Stärke Holding AG (Z&S) on a reduction of the shareholding with respect to the share capital and the sale of shares (voting rights) of the company pursuant to sec 91 et seq. BörseG as follows:

- Notification dated 6 February 2017 (Reduction of the shareholding with respect to the share capital):

On 6 February 2017, AGRANA has been informed that with legal validity of the capital increase of AGRANA dated 2 February 2017, the interest of Z&S in voting rights of AGRANA fell below the reporting threshold of 90% on 2 February 2017. The relevant interest in voting rights is 83.38% (12,938,772 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares). 4.51% (700,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are held by Z&S in form of a call option for AGRANA-shares against Südzucker. The exercise period for the call option starts on 23 August 2017.

Furthermore, AGRANA has been notified on 6 February 2017 that with legal validity of the capital increase of AGRANA dated 2 February 2017, the relevant interest in voting rights of AGRANA attributable to ABH as direct sole shareholder of Z&S is 83.38% (12,938,772 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) and ABH crossed the reporting threshold of 90%. 4.51% (700,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are indirectly held by ABH due to a call option of Z&S for AGRANA-shares against Südzucker. The exercise period for the call option starts on 23 August 2017.

AGRANA has also been notified on 6 February 2017 that with legal validity of the capital increase of AGRANA dated 2 February 2017, the relevant interest of Südzucker and SZVG in voting rights of AGRANA held through the shareholding in ABH and as a party of a shareholder's agreement (between Südzucker and ZBG with accession of indirect and direct shareholders of ZBG) is 89.36% (13,867,201 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares), and, thus, the relevant interest in voting rights crossed the reporting threshold of 90%, respectively. 4.51% (700,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares), which are not attributed pursuant to the shareholder's agreement, are attributed due to the call option of Z&S for AGRANA-shares against Südzucker itself as option writer. Therefore the shares subject to the call option are double-counted in the total relevant interest in 89.36% of the voting rights. The 'adjusted' total interest in voting rights is 84.85%.

AGRANA has further been notified on 6 February 2017 that with legal validity of the capital increase of AGRANA dated 2 February 2017, the total relevant interest of RHO, which is the indirect controlling shareholder of ZBG through its shareholdings in LAREDO, LLI, MZ, Estezet and ALMARA (all Vienna), in voting rights of AGRANA is 83.62% (12,976,772 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) and, thus, the reporting threshold of 90% has been crossed. 4.51% (700,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are indirectly held by RHO due to a call option of Z&S for AGRANA-shares against Südzucker. The exercise period for the call option starts on 23 August 2017. The direct voting rights of Z&S and the indirect voting rights of ABH through its shareholdings in Z&S are also attributed to each of LAREDO, LLI, MZ, Estezet and ALMARA. Hence, the respective total relevant interest is 83.38% (12,938,772 AGRANA-shares) of the voting rights, and thus, the reporting threshold of 90% has been crossed, respectively.

- Notification dated 7 February 2017 (Sale of shares (voting rights) of the company):

AGRANA has been notified on 7 February 2017 that with legal validity of the sale of 500,000 AGRANA-shares by Südzucker by way of a private placement (parallel to the capital increase of AGRANA) effective as of 7 February 2017 (Settlement), the interest of Z&S on 7 February 2017 is 80.15% of the voting rights of AGRANA (12,438,772 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares). As a result of the sale of 500,000 AGRANA-shares by Südzucker, the call option of Z&S for AGRANA-shares against Südzucker has been reduced to 200,000 AGRANA-shares. Therefore, 1.29% (200,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are held by Z&S in form of a call option for AGRANA-shares against Südzucker. The reporting threshold of 4% has been crossed. The exercise period for the call option starts on 23 August

Furthermore, AGRANA has been notified on 7 February 2017 that with legal validity of the sale of 500,000 AGRANA-shares by Südzucker by way of a private placement (parallel to the capital increase of AGRANA) effective from 7 February 2017, the relevant interest in voting rights of AGRANA attributable to ABH as direct sole shareholder of Z&S on 7 February 2017 is 80.15% (12,438,772 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares). As a result of the sale of 500,000 AGRANA-shares by Südzucker, the call option of Z&S for AGRANA-shares against Südzucker, which is attributable to ABH, has been reduced to 200,000 AGRANA-shares. Therefore, 1.29% (200,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are held by ABH (through Z&S) due to the call option for AGRANA-shares against Südzucker. The reporting threshold of 4% has been crossed. The exercise period for the call option starts on 23 August 2017.

AGRANA has further been notified on 7 February 2017 that with legal validity of the sale of 500,000 AGRANA-shares by Südzucker by way of a private placement (parallel to the capital increase of AGRANA) effective from 7 February 2017, the relevant interest in voting rights of AGRANA directly held by Südzucker on 7 February 2017 is 2.76% (428,429 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares). This stake also includes 200,000 AGRANA-shares that are subject to a call option granted by Südzucker to Z&S. Without consideration of any attribution, the relevant direct interest of Südzucker in AGRANA crossed the reporting thresholds of 5% and 4%.

AGRANA has also been notified on 7 February 2017 that with legal validity of the sale of 500,000 AGRANA-shares by Südzucker by way of a private placement (parallel to the capital increase of AGRANA) effective from 7 February 2017, the relevant interest of Südzucker and SZVG in voting rights of AGRANA held through the shareholding in ABH and as a party of a shareholder's agreement (between Südzucker and ZBG with accession of indirect and direct shareholders of ZBG) on 7 February 2017 is 82.91% (12,867,201 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares). 1.29% (200,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares), which are not attributed pursuant to the shareholder's agreement, are attributed due to a call option for AGRANA-shares against Südzucker itself as option writer. The shares subject to the call option are therefore double-counted in the total relevant interest of 82.91% of the voting rights. The 'adjusted' total interest in voting rights is 81.63%.

AGRANA has further been notified on 7 February 2017 that the total relevant interest of RHO, which is the indirect controlling shareholder of ZBG through its shareholdings in LAREDO, LLI, MZ, Estezet and ALMARA (all Vienna), in the voting rights of AGRANA is 80.40% (12,476,772 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares). With legal validity of the sale of 500,000 AGRANA-shares by Südzucker, the call option of Z&S for AGRANA-shares against Südzucker, which is attributed to RHO, has been reduced to 200,000 AGRANA-shares. Therefore, 1.29% (200,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are indirectly held by RHO due to a call option of Z&S for AGRANA-shares against Südzucker. The reporting threshold of 4% has been crossed. The exercise period for the call option starts on 23 August

2017. The direct voting rights of Z&S and the indirect voting rights of ABH through its shareholding in Z&S are also attributed to each of LAREDO, LLI, MZ, Estezet and ALMARA. Hence, the respective total relevant interest is 80.15% (12,438,772 AGRANA-shares). With legal validity of the sale of 500,000 AGRANA-shares by Südzucker, the call option of Z&S for AGRANA-shares against Südzucker, which is attributed to each of LAREDO, LLI, MZ, Estezet and ALRMARA, has been reduced to 200,000 AGRANA-shares. Therefore, 1.29% (200,000 AGRANA-shares) of all AGRANA-shares issued (15,518,760 AGRANA-shares) are attributed to the above mentioned companies and in each case the reporting threshold of 4% has been crossed.

This notification is also available on the website of AGRANA www.agrana.com.

end of announcement euro adhoc

issuer: AGRANA Beteiligungs-AG F.-W.-Raiffeisen-Platz 1 A-1020 Wien phone: +43-1-21137-0 FAX: +43-1-21137-12926 mail: info.ab@agrana.com WWW: www.agrana.com sector: Food ISIN: AT0000603709 indexes: WBI, ATX Prime

stockmarkets: Präsenzhandel: Berlin, Stuttgart, Frankfurt, official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/4/aom

Börsenradio Live-Blick, Fr. 17.5.24: DAX schwächer, 4x Dividende, Special zum Nebenwerte-Bösewicht MiFID II, AT&S-Comeback

Agrana

Uhrzeit: 11:39:35

Veränderung zu letztem SK: 0.37%

Letzter SK: 13.60 ( -0.73%)

Bildnachweis

1.

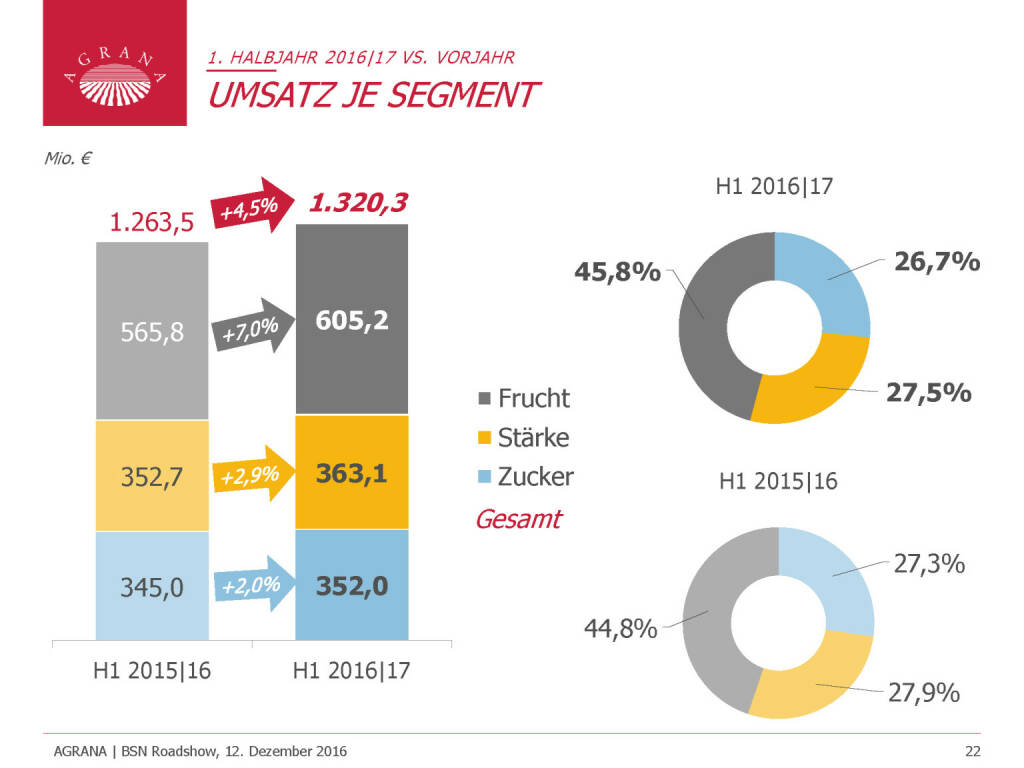

Agrana - Umsatz je Segment

>> Öffnen auf photaq.com

Aktien auf dem Radar:FACC, Rosenbauer, AT&S, Amag, Flughafen Wien, Frequentis, Addiko Bank, Rosgix, Palfinger, Pierer Mobility, Erste Group, Österreichische Post, Marinomed Biotech, Gurktaler AG Stamm, Polytec Group, S Immo, Agrana, CA Immo, EVN, Immofinanz, Kapsch TrafficCom, OMV, Telekom Austria, Uniqa, VIG, Wienerberger, Siemens, BMW, Sartorius, DAIMLER TRUCK HLD..., Wal-Mart.

Random Partner

Aluflexpack AG

Das Kerngeschäft der Aluflexpack AG (Aluflexpack) umfasst die Entwicklung und Herstellung hochwertiger flexibler Primärverpackungen im industriellen Ausmaß mit einem Schwerpunkt auf Aluminium basierten Verpackungen wie zum Beispiel Aluminium-Kaffeekapseln, Standbodenbeutel, Alu-Schalen, Deckel, Verpackungen für die Süßwarenindustrie und Durchdrückpackungen für den Pharmabereich.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2H9F5 | |

| AT0000A3B0N3 | |

| AT0000A2VKV7 |

- Börsenradio Live-Blick 17/5: DAX schwächer, 4x Di...

- Analysten zu Flughafen Wien: "Solide operative Le...

- wikifolio Champion per ..: Jörn Remus mit Nordstern

- Börsepeople im Podcast S12/20: Heinz Walter

- Unser Robot zum Dow: 40.000 intraday und Wal-Mart...

- Analysten zu Polytec - "Aktie stark unterbewertet"

Featured Partner Video

Sensation im Abseits

Das Sporttagebuch mit Michael Knöppel - 3. Mai 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 3. Mai...

Books josefchladek.com

Found Diary

2024

Self published

Duelos y Quebrantos

2018

ediciones anómalas

Bolnichka (Владислава Краснощока

2023

Moksop

Spurensuche 2023

2023

Self published

Helen Levitt

Helen Levitt Naotaka Hirota

Naotaka Hirota Valie Export

Valie Export Dominic Turner

Dominic Turner Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Kurama

Kurama